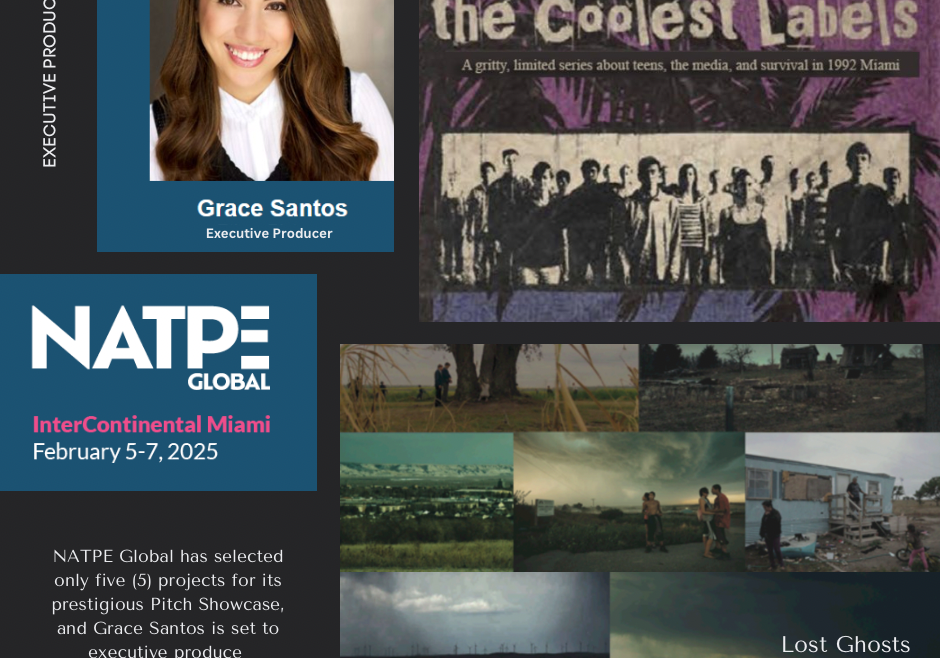

Grace Santos Executive Produces Two Series Chosen by the NATPE Global Pitch Showcase

MIAMI (January 30, 2025) – NATPE Global has selected only five projects for its prestigious Pitch Showcase, and Grace Santos is set to executive produce two of them.

The NATPE Global Pitch Showcase is an international live pitch event aimed at advancing the development of TV projects in the scripted programming space. This year, five standout projects were chosen to pitch live on stage to industry executives and TV professionals.

“I’m incredibly grateful to NATPE for this opportunity to share our projects with such influential decision-makers,” said Grace Santos. “Being selected as a finalist is a huge honor, and I’m excited to collaborate with my talented team to bring these stories to life. This is a chance to connect with the industry and showcase narratives that resonate globally.”

The Coolest Labels Set in 1990s Miami, The Coolest Labels is an eight-episode limited series based on the novel of the same name. It captures the struggles and triumphs of high school students in the aftermath of Hurricane Andrew. Root High School opens its doors to hundreds of displaced and traumatized teens from diverse ethnic and socioeconomic backgrounds. Amid rising tensions, the series explores whether the students will unite or fall apart. The novel, pilot script, and series bible are written by Fred Smith, who attended the real-life high school during this tumultuous time. One of the directors attached to the series is Nayip Anthony Garcia, a director renowned for launching the careers of young talent and collaborating with top artists such as Camila Cabello and Sofia Carson. Grace Santos serves as executive producer.

Lost Ghosts A mystery-driven crime series, Lost Ghosts is set in rural Manitoba, Canada. The first season follows Toronto-based freelance reporter Charlie Merchant as she investigates the disappearance of two girls. The journey forces Charlie to confront her Ojibwe heritage, the dangers surrounding an oil fracking operation accused of poisoning the community, and the issue of violence against women and girls. Writers S.M. Turrell, a TIFF Filmmaker Lab Alumnus and award-winning Metis director/writer, & Andrew Kirkwood, an experienced writer, bring their creative synergy to the project. Gabriel Correa an award-winning director with director credits on Riverdale and assistant director credits on The Twilight Saga, Supernatural, directs, while Kevin Leeson (1922, The Confirmation), Correa, and Grace Santos serve as executive producers.

About NATPE The National Association of Television Program Executives (NATPE) is a global content association dedicated to shaping the future of television and streaming content. Renowned for its prestigious conferences and showcases, NATPE brings together top industry leaders, decision-makers, and creative talent. Its events often feature high-profile speakers, including studio executives, showrunners, and influential creators, fostering an environment of collaboration and innovation in the entertainment world. This year, the NATPE conference will be held in Miami from February 5-7, 2025, with the Pitch Showcase scheduled for February 6. The NATPE Global advisory board features industry leaders such as Javiera Balmaceda (Amazon MGM Studios), Sheila Aguirre (FremantleMedia), Courtney Thomasma (AMC Networks), Scott Herbst (Lionsgate), Harry Gamsu (Warner Bros. Discovery Television Group), among others. http://global.natpe.com

About Grace Santos Grace Santos is an Executive Producer, Producer, and Attorney with an extensive track record in film and television. Her producing credits include the upcoming teen comedy Almost Popular (2025) directed by Nayip Anthony Garcia and starring Ruby Rose Turner (Disney’s Descendants), Isabella Ferreira (Netflix’s Incoming), and Elijah M. Cooper (Disney’s Goosebumps, CW’s All American) and AFI DWW’s Silk (by Catherine Dent, starring Shohreh Aghdashloo) and Election Night (by Tessa Blake, starring Peri Gilpin). Grace has held leadership roles in entertainment companies that have financed, produced, and distributed hundreds of films and television content, including VP and Head of Business Affairs and Operations for Gamechanger Films, Development and Production Executive at Patriot Pictures, Vice President of Business Affairs and part of the programming team for the Bentonville Film Festival, and Director of Business & Legal Affairs for RLJ Entertainment/ALLBLK/AcornTV (now part of AMC Networks). She also serves on the Board of FilAm Creative, a Los Angeles nonprofit that champions Filipino American stories. Grace was part of the 2020 Producers Guild of America Power of Diversity Lab.

Collaborators for Lost Ghosts:

- Kevin Leeson: Kevin has produced over 20 film and TV projects, including Life on the Line (starring John Travolta) and The Confirmation (starring Clive Owen). https://imdb.com/name/nm1016634/

- Gabriel Correa: An award-winning director, Gabriel has helmed several episodes of the Netflix/WB hit Riverdale. A graduate of Fundação Armando Alvares Penteado in São Paulo and the Vancouver Film School, he also directed Beautiful Gun, winner of the Directors Guild of Canada BC Short Film Awards. Gabriel’s background as an Assistant Director includes work on The Twilight Saga, Godzilla, and seasons 2 through 12 of Supernatural. https://imdb.com/name/nm3286970/

- S.M. Turrell & Andrew Kirkwood: Sean and Andrew have collaborated since 2005 on screenplays, series, and novels. Sean, a TIFF Filmmaker Lab Alumnus, is a Métis filmmaker with multiple awards for dramas and documentaries. Andrew, an honours graduate of Carleton University’s English program, is a freelance writer of screenplays, series, articles and poetry.

Collaborators for The Coolest Labels:

- Fred Smith: Fred writes novels, screenplays, television series, and articles. His novel, The Coolest Labels, is set in Miami in 1992 and is about a group of disparate teens trying to put their lives back together amid the traumatic wake of Hurricane Andrew. The Closet, a collection of dark short stories and Invisible Innocence: my story as a homeless youth, is the autobiographical story of a former abandoned teen. http://theonlyfredsmith.com

- Nayip Anthony Garcia: Nayip is a director that has launched the careers of Johnny Orlando, Mackenzie Ziegler, Carson Lueders, Kylie Cantrall, Ruby Rose Turner, and countless more. Nayip has also partnered with top artists including Tim McGraw, Camilla Cabello, Alessia Cara, and Kelsea Ballerini. His expertise in youth culture translates seamlessly to scripted youth-based content. http://nayipramos.com

With a team of seasoned creatives, each bringing unique expertise and accolades, these projects exemplify the collaborative spirit that drives groundbreaking storytelling.

# # #

orm for female and diverse voices. It’s the only festival that I know of that guarantees distribution to the winners on all platforms – theatrical (through AMC), digital and television (through ARC, Anchorbay/Starz, TV1, or Lifetime), and home video (through BFF’s founding sponsor Walmart and the other sponsors previously mentioned). It was co-founded last year by Academy Award Winner Geena Davis and Hollywood Exec Trevor Drinkwater.

orm for female and diverse voices. It’s the only festival that I know of that guarantees distribution to the winners on all platforms – theatrical (through AMC), digital and television (through ARC, Anchorbay/Starz, TV1, or Lifetime), and home video (through BFF’s founding sponsor Walmart and the other sponsors previously mentioned). It was co-founded last year by Academy Award Winner Geena Davis and Hollywood Exec Trevor Drinkwater. Alex Cohen (NPR); Panelists: Geena Davis, Kimberly Paisley, Nia Vardalos, and Meg Ryan. For an industry that offers so few opportunities for women and minorities, increasing numbers of talented women are pushing back by taking control of their own interests rather than depending on the powerful commercial studios. This panel will feature celebrities who have taken control of their destiny by starting their own production companies and making their own films.”

Alex Cohen (NPR); Panelists: Geena Davis, Kimberly Paisley, Nia Vardalos, and Meg Ryan. For an industry that offers so few opportunities for women and minorities, increasing numbers of talented women are pushing back by taking control of their own interests rather than depending on the powerful commercial studios. This panel will feature celebrities who have taken control of their destiny by starting their own production companies and making their own films.”